Nigeria is residence to Africa’s largest cellular market by a ways, with 217.5 million subscriptions on the finish of 2023, up from 209.5 million a 12 months earlier.

The subsequent largest African markets at end-2023 have been South Africa with 118.9 million subscriptions, and Egypt with 111.1 million, in line with TeleGeography’s GlobalComms Database.

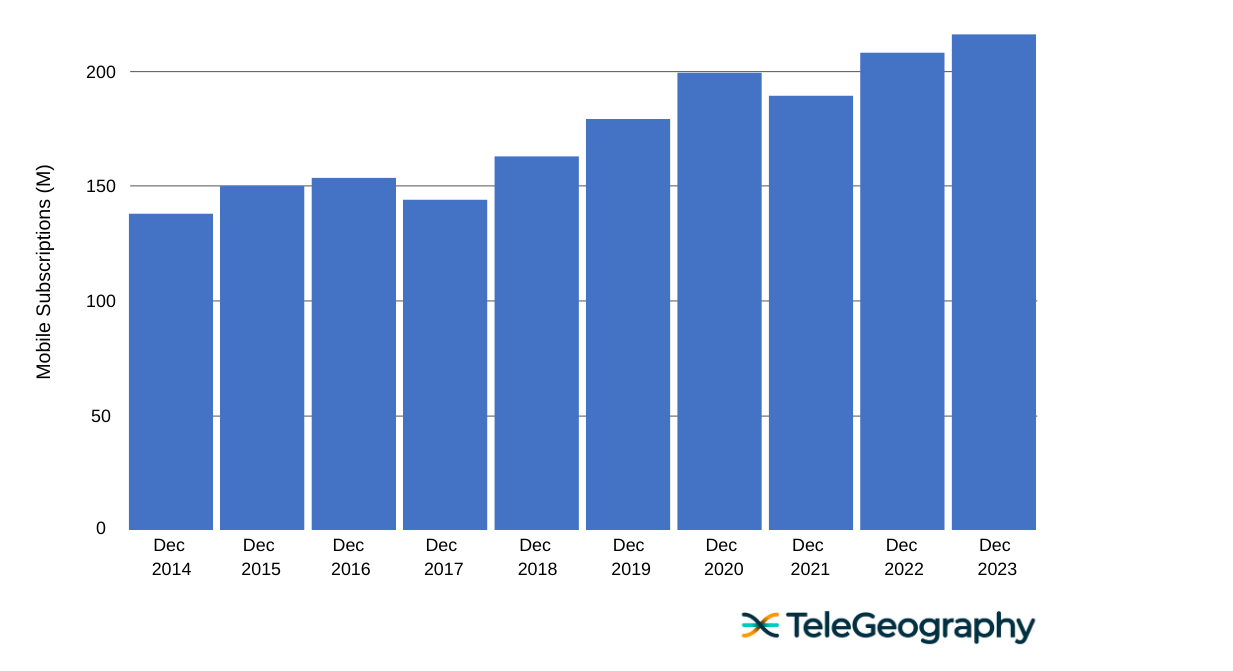

Following years of robust progress, the Nigerian cellular sector registered its first annual contraction in 2017. Nigeria’s variety of subscriptions dropped by 6.2% that 12 months, because of a SIM registration marketing campaign that resulted within the disconnection of thousands and thousands of inactive or incorrectly registered accounts.

Development resumed in This fall 2017, averaging an annual charge of 11% for the next three years. By end-2020, Nigeria reached 200.7 million lively SIMs.

Speedy progress got here to a halt in 2021, nevertheless, following the implementation of new rules to power all cell phone customers to replace their registration with their Nationwide Id Quantity (NIN). This transfer additionally noticed the sale and activation of latest SIMs for all operators briefly suspended from December 2020 till the next April.

As such, the market whole declined by 5% in 2021. In early April 2022, the NIN-SIM linkage train got here to an finish, permitting the annual progress charge to rebound to 10%. The subscription whole rose a extra modest 4% in 2023.

Latest Development

Nigeria, Cellular Subscriptions Development 2014-2023

Though properly forward of different African international locations by way of subscription quantity, relating to inhabitants penetration, Nigeria sits thirtieth out of 57 international locations, with a determine of 96%.

Whereas that statistic could look affordable, there are nonetheless tens of thousands and thousands of Nigerians with out connectivity. The penetration charge is boosted by the big numbers of customers who personal two or extra SIM playing cards as a way to make the most of on-network airtime offers.

The working atmosphere poses numerous vital challenges, together with worsening financial circumstances, insufficient energy provide, gasoline shortages, a number of taxation, vandalism of community infrastructure, forex depreciation, and heightened instability in a number of areas.

Operators have complained that they’re struggling to deal with large power value rises, with power now accounting for round 40% of working prices, in line with some estimates.

MTN in First Place

South African-owned MTN leads the sector, controlling 36.6% of all Nigerian cellular customers on the finish of 2023 with 79.7 million subscriptions.

MTN has maintained its primary place regardless of regulatory measures adopted by the Nigerian Communications Fee (NCC) to mitigate its vital market energy, in addition to current strikes by the operator itself to disconnect thousands and thousands of subscriptions with incomplete registration paperwork.

The latter resolution was prompted by the hefty high quality MTN obtained in October 2015 for failing to satisfy a deadline to disconnect round 5.1 million unregistered SIMs. The preliminary NGN1 trillion ($5.2 billion) penalty was ultimately negotiated right down to NGN330 billion by mid-2016.

As a part of the settlement association for the high quality, MTN Nigeria dedicated to itemizing a portion of its shares on the Nigeria Inventory Trade. This ultimately befell in Might 2019 through a “itemizing by introduction,” adopted by a public supply on the finish of 2021, which noticed MTN Group’s shareholding in its Nigerian unit lowered from 78.8% to 75.6%.

The cellco’s efficiency lately has additionally been severely impacted by the suspension of regulatory providers by the NCC, which restricted the introduction of any new tariff plans and promotions till March 2016. Extra contributing elements embrace financial circumstances and the restricted availability of U.S. {dollars}.

Three Most important Rivals

MTN is just not the one Nigerian operator going through vital challenges to its enterprise.

MTN is just not the one Nigerian operator going through vital challenges to its enterprise.

9mobile—the nation’s fourth largest cellco by subscriptions—was pressured right into a rebranding in July 2017 and the following sale of its operations.

After defaulting on a $1.2 billion mortgage because of an financial downturn, forex devaluation, and greenback shortages, talks with banks did not carry a decision. UAE-based buyers Mubadala Improvement Firm and Etisalat Group (now e&) then pulled out, forcing Etisalat Nigeria to rebrand to 9mobile.

The Teleology Nigeria consortium emerged as the popular bidder for 9mobile in February 2018 with a suggestion of $301 million, beating the one different participant, Smile Telecoms. Nonetheless, by early 2019, shareholder disagreements noticed some buyers stroll away.

All of this had a notable affect on 9mobile’s subscription base, leaving it properly behind its three bigger rivals with a market share of simply 6.4% at end-2023.

MTN Out Entrance

Nigerian Cellular Market, December 2023

.png?width=1280&height=729&name=Nigerian%20Mobile%20Market%2c%20December%202023%20(1).png)

The second and third-placed gamers are nearly neck-and-neck in subscription phrases.

Indian-owned operator Airtel Nigeria claimed 61.8 million subscriptions and 28.4% of the market as of December 2023. Initially launched beneath the title Econet Wi-fi Nigeria in December 2000, the cellco subsequently got here beneath the management Kuwait’s Zain Group.

In March 2010, Bharti Airtel of India agreed to amass nearly all of Zain Group’s African property in a $9 billion deal that included Zain Nigeria. The takeover concluded in June 2010 and Zain Nigeria was rebranded beneath the Airtel moniker by the tip of that 12 months.

Shut rival Globacom, which trades beneath the Glo title, is majority owned by Nigerian petrochemical agency Conpetro. Globacom was awarded Nigeria’s second nationwide operator license in August 2002 and obtained the nation’s fourth nationwide GSM concession as a part of the bundle.

Glo may declare 28.3% of the entire market at end-2023, with 61.6 million subscriptions.

Rounding out the sector are a handful of small 4G and 5G operators with negligible market shares. They embrace Smile Communications, which was based in 2008 by pan-African operator Smile Telecoms Holdings and awarded a license in July 2009. It took Smile till February 2013 to launch its FDD-LTE community.

Ongoing Issues

Nigeria’s cellular operators continuously face complaints from each the NCC and shoppers over poor high quality of service and community congestion, however in flip have claimed that vandalism of infrastructure, a number of taxation, and insufficient energy provide hamper their efforts to function successfully.

Moreover, heightened instability and unrest in a number of elements of the nation have restricted the power to hold out routine upkeep and emergency repairs.

Moreover, heightened instability and unrest in a number of elements of the nation have restricted the power to hold out routine upkeep and emergency repairs.

Airtel’s infrastructure was badly affected by insurgents within the northeast in early 2020, and MTN’s community was restricted within the northern states on the finish of 2021 to deal with safety points.

Within the absence of a dependable electrical energy grid, base stations have to be served by mills and powered by diesel. As well as, telecom firms proceed to face a number of taxation at native, state, and federal degree, with service disruptions associated to tax claims stated to value the trade thousands and thousands of {dollars} yearly.

The Affiliation of Licensed Telecommunications Operators of Nigeria warns that native authorities businesses continuously threaten to close down base stations in numerous states if firms fail to pay quite a few taxes and levies. MTN, for one, says it has suffered arbitrary enforcement actions and repair disruptions by events engaged on behalf of tax-raising our bodies.

All of those points actually make the Nigerian cellular market one to look at.