- Report Yr of Robust Development

- Report Income development of 149.73% YoY at Rs. 876.44 crores and Report PAT development of 167.55% YoY at Rs. 148.04 crores

- Unexecuted Orderbook of two,365 MWp to be executed in subsequent 18 months

Waaree Renewable Applied sciences Restricted, the Photo voltaic EPC subsidiary of Waaree Group, a photo voltaic developer that funds, constructs, owns and operates photo voltaic tasks, has reported its audited monetary outcomes for the quarter and 9 month ended March 31, 2024.

KEY PERFORMANCE HIGHLIGHTS

FY24

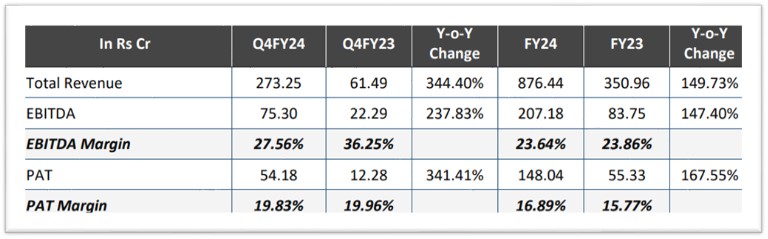

- Income for FY24 stood at Rs. 876.44 crores representing a development of 149.73% YoY as in comparison with Rs.350.96 crores in FY23

- EBITDA for FY24 stood at Rs. 207.18 crores as in comparison with Rs. 83.75 crores in FY23 representing a development of 147.40% YoY

- PAT for FY24 stood at Rs. 148.04 crores as in comparison with Rs. 55.33 crores in FY23 representing a development of 167.55% YoY

Q4FY24

- Income for Q4FY24 stood at Rs. 273.25 crores representing a development of 344.40% YoY as in comparison with Rs. 61.49 crores in Q4FY23

- EBITDA for Q4FY24 stood at Rs. 75.30 crores as in comparison with Rs. 22.29 crores in Q4FY23 representing a development of 237.83% YoY

- PAT for Q4FY24 stood at Rs. 54.18 crores as in comparison with Rs. 12.28 crores in Q4FY23 representing a development of 341.41% YoY

Order guide Place:

- Unexecuted order guide stands at 2,365 MWp

- Bidding pipeline stays strong

Key Updates:

- The Firm has efficiently accomplished the company motion of a inventory cut up, lowering the face worth of its Fairness shares within the ratio of 1:5 per share. The face worth of shares now stands at Rs. 2/- per share

- Current Order Wins

- 980 MWp Floor Mounted solar energy undertaking

- 412 MWp Floor Mounted solar energy undertaking

- 450 MWp Floor Mounted Solar energy Mission

- 4 MWp Floor Mounted solar energy undertaking

Commenting on the outcomes Mr. Dilip Panjwani, CFO, Waaree Renewable Applied sciences Restricted stated: “As an organization dedicated to driving sustainable options, we’re excited to share our progress and the numerous alternatives that lie forward. India has set an bold goal to cut back the carbon depth of the nation’s economic system by lower than 45% by the tip of the last decade, obtain 50 p.c cumulative electrical energy put in by 2030 from renewables, and obtain net-zero carbon emissions by 2070. The nation goals for 500 GW of renewable vitality put in capability by 2030.

The nation’s renewable vitality market is on the rise, with a document 69GW of bids in FY2024, surpassing the federal government’s goal. Solar energy, each grid-scale and rooftop, stays the first contributor, accounting for 81% of the added capability. The put in photo voltaic vitality capability has elevated by 30 occasions within the final 9 years and stands at 81.81 GW as of March 2024.

Coverage initiatives just like the PM Surya Ghar: Muft Bijli Yojana goal to additional increase photo voltaic installations, significantly in residential areas. With a powerful steadiness sheet and disciplined monetary administration, the main target is on executing worthwhile tasks with larger returns. This progress signifies not solely environmental strides but additionally promising financial prospects in India’s renewable vitality panorama.

We’re additionally happy to tell you that the board of administrators has really useful a dividend of Rs. 1/- for the face worth of share of Rs. 2/- every. With a sound steadiness sheet and disciplined capital administration, we’re well-equipped for the following part of development. We additionally wish to prolong our gratitude to stakeholders for his or her continued belief and help.”