Observe, this text varieties the intro part to a brand new editorial report from RCR Wi-fi about ‘non-public 5G – hyper versus actuality’. The complete report is obtainable to obtain free of charge right here. It could be taken, as nicely, with new numbers (simply in; April 11) from Dell’Oro Group which say the market jumped 40 p.c in 2023, and stays a “huge alternative”.

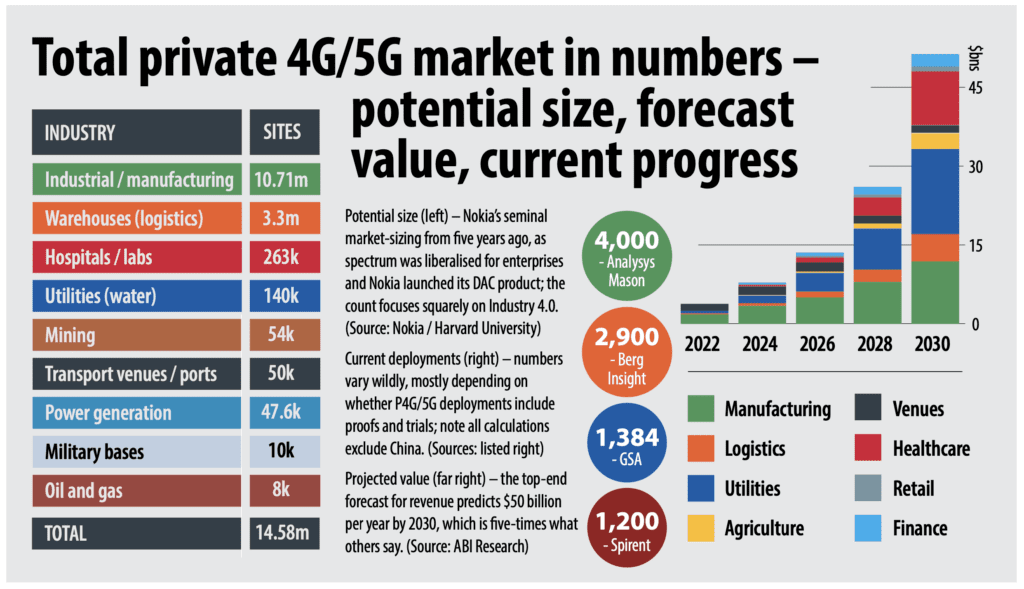

The non-public 5G market is spooked, apparently. Figures from Analysys Mason predict bountiful progress over the subsequent 5 years (4,000 to 60,000 whole deployments; $1 billion to $9 in annual spend), but in addition say that the market can have failed by the tip of the interval as a result of it has “not reached its potential”. However is that potential, actually? Or is it hype? Or is it only a slender view of the market? As a result of each calculation and forecast on the market – which disagree in regards to the particulars however agree in regards to the message (“progress”) – certainly takes its cue from a market overview commissioned by Nokia 5 years in the past which stated the addressable marketplace for non-public 5G may stretch to 14 million industrial venues.

Let’s pause on that 14-million determine for a second. It was mapped-out by Harvard College to count-out Nokia’s industrial targets – which have develop into the trade’s targets. Ten million factories, three million warehouses, 50,000 mines, or something-like; plus in all places else in Business 4.0 (see graphic under) – it captures the epic sweep of the commercial sector, and the grand promise of business revolution. It’s a good clarification of why the market is so buzzed, and likewise so hyped. For context, there are solely (!) seven million macro radio websites on the planet, as deployed by cellular operators in public networks – and that double-sized 14 million determine counts simply venues, not radios.

And so yeah: 4,000 out of 14 million is just not very a lot (0.0003 p.c; and never even), and abject failure by most measures. And it’s the similar irrespective of whose numbers you select, nor how they’re counted. Berg Perception says there have been 2,900 non-public LTE/5G networks (together with trials and proofs) on the finish of 2023, and there might be 11,900 in 2028. The World cellular Suppliers Affiliation (GSA) counted 1,384 enterprises with at the least one commercial-scale (€100,000-plus) non-public LTE/5G community firstly of 2024, primarily based on shared vendor information. Take a look at firm Spirent, with its personal market overview, settles on about 1,200 industrial non-public LTE/5G installations globally, excluding China.

“There are hundreds in China, however they don’t seem to be essentially clear-cut non-public,” feedback Stephen Douglas, head of market technique at Spirent. Income figures are equally arduous to discern. What to imagine? Who to imagine? Once more, Analysys Mason says annual spending on non-public LTE/5G will attain $9.2 billion in 2028, an 800 p.c rise over 5 years. SNS Telecom & IT, primarily based out of Dubai, says spending will hit $6.4 billion by 2026, an 18 p.c compound yearly soar over the interval. (Dell’Oro’s newest figures ought to be thought of right here, too.) ABI Analysis predicts a a lot greater income alternative: $50 billion (5 occasions the Analysys Mason forecast) per yr by 2030 – and that’s only for non-public 5G.

The entire market, together with non-public LTE (4G), might be value considerably extra – “roughly twice as a lot”, it says. “By 2030/31, we’ll attain a turning level, the place non-public 5G takes over from 4G because the dominant cellular-based enterprise networking know-how,” feedback Leo Gergs, principal analyst at ABI Analysis. However even such top-end forecasts are drops-in-the-ocean in comparison with Nokia’s authentic 14-million rely, and the revenues that may go in opposition to it. Analysys Mason notes an annual spend of $9.2 billion could be lower than 5 p.c (and $50 billion could be lower than 25 p.c) of its personal forecast spend on public networks in the identical timeframe.

As such, it’s straightforward to see why the non-public networks sport could be perceived as a failure, to this point. “The market is not going to have reached its potential,” writes Analysys Mason. But it surely says, as nicely, that curiosity “stays excessive regardless of the comparatively modest long-term alternative”, and it agrees broadly with ABI Analysis that the LTE/5G tipping level within the enterprise area will come on the finish of the last decade. Virtually half (47 p.c) of personal networks might be primarily based on 5G in 2028, it says; the remainder might be LTE programs, lowering in proportion from about three quarters (75 p.c) of whole deployments in 2022. “Curiosity in non-public 5G is excessive however… units and prices have held again adoption,” it says.

Ah, units and prices; after all. We are going to come again to those. However Analysys Mason additionally explains-away the market’s progress from totally different points-of-view – for conventional cellular operators, but in addition for legacy and startup tools distributors (Nokia and Ericsson, notably, versus Celona, Athonet/HPE, plus others). “Personal networks will present a small enhance to operators’ enterprise income,” it says. In the meantime, legacy distributors will take into account the revenue as “helpful incremental income” and newbies will take into account “even a market of just some billion {dollars} is vastly enticing”. This is a vital perspective, and ought to be thought of when assessing the varied responses on this article.

HYPE TENSIONS

However the hype-fallout, because the promise outruns the truth, has appeared to create real panic within the provider market – as a result of the gross sales numbers don’t replicate the impetus that distributors had anticipated, or else, possibly, simply because it’s an excessive amount of like arduous work. It’s anecdotal, and somewhat vibrant, however the off-record temper at Cellular World Congress in Barcelona in late February (2024) was a darkish one, stuffed with hearsay and intrigue, and determined seems – as if nobody is sort of certain of the street forward, and a few are heading for the skids (see the information that Casa Methods and Airspan Networks have hit the skids, recently; see additionally stated sketches-of-Spain). Talking forward of MWC (and never at it), Celona stated the wheels have locked for some corporations, and the street has cleared for just a few others.

Responding to a direct query about whether or not opportunist suppliers have began to flee the non-public 5G sport because it slumps right into a ‘trough of disillusionment’ (to make use of Gartner parlance), Rajeev Shah, co-founder and chief government at Celona, says: “That’s truthful; on the peak of the hype cycle, there have been a number of gamers that thought they’d a task to play, and which contributed to all of the noise. Just about everybody was coming at it, saying, ‘that is my progress space’, and placing out press releases. However the enterprise market has spoken and… that lengthy record has develop into a brief record of gamers; and realistically, at this level, that record includes Nokia, Ericsson, and ourselves.”

He provides: “So the quantity of noise has decreased, as a result of the variety of folks making it has decreased – as a result of their programs don’t reduce it.” So who has dropped out, then? Shah doesn’t wish to title names (and the information cycle has since revealed a few of them). However then his list-of-three excludes some main ones – together with massive cloud suppliers like AWS and Microsoft that made a splash a few years again, numerous bit-part radio and core suppliers promoting through massive integrator manufacturers, plus a swarm of noisy CBRS gamers providing associated companies, a hatful of area of interest specialists, and a handful of main IT/OT operatives. Shah performs a straight bat: “I simply suppose loads of corporations haven’t bought the traction that now we have.”

What does he make of the likes of Cisco and HPE, coming at it from an IT angle? Absolutely the brand new HPE-plus-Athonet (plus-Juniper) seems just like the type of enterprise-friendly (Wi-Fi pleasant) system that Celona likes to speak about? He responds: “I imply, the [Juniper] acquisition continues to be contemporary. However, sure, I used to be anticipating HPE and Cisco to be harbingers of the long run; greater than anybody else. And so they should still be. I anticipate them to do one thing on this area, given their robust enterprise DNA. And we see them sporadically, however I believe they’re in a growth cycle, constructing out their portfolio at this level.” However he’s not to say rather more, and that’s the tip of the dialog about vanishing rivals.

The concept of a three-horse race is preposterous, after all (as Dell’Oro’s figures clarify), even when the non-public 5G provider market is beginning to mutate within the post-hype period. The message about HPE/Athonet might be a greater clarification of how the sector is growing, nonetheless, and could be taken with equal logic in regards to the likes of AWS and Siemens, say, the place they’re ready for the know-how to develop in reverse instructions to deal with low- and high-end enterprise markets individually. Definitely, the road from Athonet at MWC is about rising gross sales. “We’ve gained extra share, finished extra deployments,” responds Gianluca Verin, chief government on the Italian agency, speaking about his firm’s acquisition by HPE a yr in the past.

He goes on: “We now have maintained the promise to take care of our prospects. Which isn’t all the time the case after an acquisition.” So what’s Verin’s view of the temper within the non-public 5G camp, extra typically – as a result of there’s this nagging sense, even simply at this present, that the hype is out of hand, and there’s a reckoning of kinds within the offing? He responds: “The market was overestimated, one or two years in the past – so there’s some down-sentiment. However as all the time with know-how, it goes up and down, and the those who make it work, like ourselves, make sure that it goes slowly however relentlessly upwards – till the day that it’s all-up and it exhibits its energy. We’re near that second now.”

There’s a reminder, as nicely, of HPE’s grand scheme to mix its Athonet and Aruba companies to make 5G and Wi-Fi right into a single community proposition. “Wi-Fi and 5G might be mixed in some way in several roles. However 5G is not going to go away,” says Verin, earlier than he reverts to the core gross sales narrative about why non-public 5G issues – and why the hype is actual. “As a result of enterprises have wants that aren’t being addressed in another method. We see fully new purposes rising… So the market is sweet, and there to be conquered. It has the eye of the highest folks in so many industries. The those who perceive this know-how perceive the way it can change issues.”

This text is sustained (throughout 32 pages) in a brand new editorial report from RCR Wi-fi on non-public 5G hype and actuality, which is free to obtain; click on right here or under for the report.