December greetings from Fraser, Colorado (picured), Cedar Rapids, Iowa, and Kansas Metropolis, Missouri. We hope the Holidays have been restful and gratifying for every of you, and that 2025 brings skilled and private progress.

For the primary time in a very long time (11 consecutive years excluding COVID-2021), Jim is not going to be attending the Shopper Electronics Present (CES) in Las Vegas (full program agenda right here). For these of you attending, we hope you learn our take under on the state of the buyer electronics trade and supply on-floor suggestions. Our thesis is that with practically $4 trillion in market capitalization, Apple is within the driver’s seat and everybody else is a passenger (and Apple has a minimal presence at CES). Extra under.

The final full Temporary (right here) generated a variety of responses on two fronts: 1) from Cedar Rapids residents, previous and current, who share our fondness of the Quaker Oats Christmas tree, and a couple of) from many feedback on the way forward for the entry edge. A kind of feedback which we didn’t point out in that Temporary was that the entry edge is rising as a result of some parts of conventional information facilities are shrinking and localized edge processing is the product of continued processing, storage, and different technological enhancements. We predict that time, plus feedback concerning the huge variations in electrical energy availability and costs, ought to be added to the earlier Temporary’s thesis.

Additionally, since this can be a Vacation week and typically the workplace will be much less busy, listed below are two very latest discussions that we’d counsel watching/ listening to as time permits.

- Chris Penrose, former 30+ yr AT&T government and now International Head Enterprise Growth – Telco for Nvidia, on the TelcoDR podcast known as Telco in 20 (right here). In addition to a really attention-grabbing software of sovereign AI (synthetic intelligence) for Indonesia, he discusses the preliminary outcomes of the Softbank subject trial (press launch right here).

- Bob Yates, who was SVP of M&A for Stage(3) Communications from 1999-2011, seems on Dan Caruso’s podcast known as The Bear Roars (right here) at the side of Dan’s upcoming guide known as Bandwidth: The Untold Story of Ambition, Deception, and Innovation That Formed the Web Age and the Dot-Com Increase (preorder right here on Amazon). There’s a second interview on The Bear Roads that’s equally entertaining from Stephanie Copeland of 4 Factors Capital, a long-time Denver telecom/ tech government.

Lastly, we need to notice the passing of two essential figures within the cable trade since our final Temporary. Dick Parsons, who was head of Time Warner once they merged with AOL and led the corporate (and plenty of others) by way of turbulent waters, handed away on December 26th (New York Instances obituary is right here). This morning, we discovered by way of a Sunday Temporary reader that Chuck Dolan, a cable pioneer who began Cablevision and HBO, handed away at age 98 (Wall Avenue Journal obituary is right here). Each have been legends, and we are going to miss their wit and knowledge significantly.

The fortnight that was

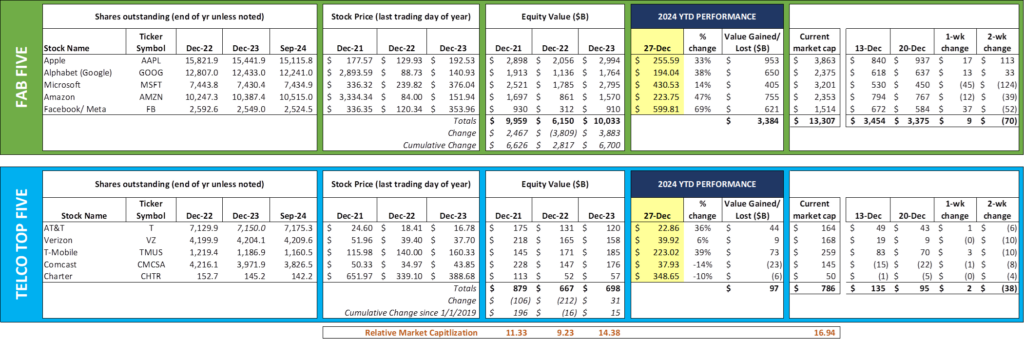

This has been a quiet week for each the Fab 5 (+$9 billion) and Telco High 5 (+$2 billion). Absent some important rally or selloff, the Fab 5 will achieve $3.3-3.4 trillion in market capitalization in 2024, down from the $3.9 billion created in 2023. During the last six years, the Fab 5 have created ~$10 trillion in market worth. The Telco High 5, against this, created $100 billion in worth over the identical interval. Stated in a different way, for each greenback created by the Telco High 5 for the reason that starting of 2019, the Fab 5 have created $100.

For the Fab 5, 2024 shall be often called the “Peak 12 months of Combating the Authorities.” Nowhere is that this extra obvious than with Mountain View-based Google/ Alphabet, who’s presently dealing with the prospect of divesting their browser division (Chrome) in addition to many different restrictions (Bloomberg article outlining every of these adjustments right here). Regardless of the looming adjustments, the inventory gained $650 billion in worth, barely greater than 2023 ($628 billion).

Alphabet just isn’t the one one dealing with investigation. Microsoft was simply handed a really broad request for info from the FTC (article right here); Apple (The Verge’s glorious protection right here), Amazon (partial dismissal of the FTC’s case in late September right here) and Meta (Reuters article right here on the 2026 trial date that might probably unwind their acquisition of Instagram right here) are all concerned in multi-year authorized actions.

Many have requested whether or not the investigation depth displayed during the last a number of years will proceed within the Trump administration. Whereas the precise reply is not going to be identified for a number of weeks, the Legal professional Basic nominee, Pam Bondi, doesn’t have the activist streak of the present lawyer basic or head of the FTC. Our guess is that activism shall be diminished, regardless of Jeff Bezos’ possession of The Washington Put up and the complicity of Meta in suppressing info on each Fb and Instagram that might have impacted the 2020 election in addition to COVID-related issues (every of which Meta CEO Mark Zuckerburg has admitted have been poor choices in a letter to the Home Judiciary Committee – see submit right here). Extra to come back, however we predict a pendulum shift again to the center-right.

Talking of regulatory actions, AT&T obtained some excellent information final week from the Federal Communications Fee (FCC) as they permitted Ma Bell’s plan to switch conventional copper line native cellphone service with AT&T Cellphone Superior, a wi-fi native cellphone various (Bloomberg article right here). Whereas this ruling applies to a handful of properties in Oklahoma, the precedent and blueprint established by an outgoing Democrat-chaired FCC units the stage for acceleration of copper retirement, a profit for each AT&T and Verizon’s telco items.

Lastly, there was a really intriguing article on Altice in Fierce Community which featured a quote by Nate Edwards (AT&T, Lumen, now Altice) that cable firms may compete in opposition to new broadband opponents utilizing cell (we utterly agree) and video. His premise is that the hole between streaming and linear broadcast programs is narrowing, and that bundling broadband, video and cell might be an efficient cudgel to firms corresponding to Frontier (who may have FiOS linear TV providing after their merger with Verizon is permitted) and upstart FTTH suppliers.

Whereas the double-play (broadband + wi-fi) is smart (see the final full Temporary right here on how we predict it’s going to affect AT&T), the incorporation of video as a vital bundle element is an actual headscratcher. Content material creators corresponding to Amazon, Netflix, and Apple are writing huge checks. Comcast and Warner Bros. Discovery are additionally segregating their linear channels as part of a plan to (probably, in WBD’s case) spin or promote these items. Linear TV served because the content material aggregator for many years, however digital aggregators (together with Xumo, the brand new video platform for Altice) are taking on. We predict that Nate’s feedback would possibly assist Altice with sure segments, and positively will assist cut back the substantial churn Altice has skilled, however linear video is at greatest a distant third half to what shall be a broadband+wi-fi play.

CES preview—AI helps however doesn’t remake the buyer electronics trade

There shall be a variety of dialogue on the upcoming Shopper Electronics Present about how synthetic intelligence will remake the trade. “Mix a superior mass market massive language mannequin (LLM) with first rate {hardware} specs and the trade construction will essentially change” is the favored thought.

Whereas we agree that AI shall be a strong drive and drive handset upgrades because it turns into an indispensable a part of society, it doesn’t upend the present shopper electronics construction which is dominated by Apple. As we stated in our opening feedback, the Cupertino large, with practically $4 trillion in market capitalization, has probably the most to lose if AI proves to be revolutionary, they usually have the stability sheet and market share to make sure that any developments profit the iPhone enterprise mannequin.

Whereas we now have not mentioned this shortly, listed below are three issues we predict has made Apple profitable for the reason that launch of the Macintosh in 1984:

- Being as tightly built-in (closed) as potential. From the start of the corporate, software program integration into {hardware} has been tightly managed. Whereas many causes are cited (together with safety, effectivity, consumer expertise and value), the consequence is identical: Apple views their product as a mixture of {hardware} and software program. We don’t suppose that basis will crumble due to a wave of AI apps.

- Creating merchandise that may be simply marketed. Apple turned computing into one thing that was “cool” within the Eighties and reinvented the music trade in 2000s with the launch of iTunes and the iPod. The phrase “A thousand songs in your pocket” nonetheless stands as one of the highly effective product tag strains in shopper electronics historical past. The iPhone turned Apple into a world aspirational model and compelled Apple to work with lots of of wi-fi carriers working a myriad of networks throughout dozens of spectrum bands. They eliminated community compatibility as a barrier to buy – no small feat.

- They weren’t _________. Within the early days, that clean was stuffed by Microsoft (queue the Mac vs PC adverts). As their market management has grown, overtly direct comparisons to particular firms (and even the Android working system) have pale into the background. We see T-Cellular’s “Challenger to Champion” mantra as an try to comply with Apple’s transition.

There are numerous extra elements to Apple’s success that we shouldn’t have time to debate on this column, a few of that are immediately attributable to Tim Prepare dinner. However the three talked about above, mixed with the traits of profitable massive language fashions, lead us to imagine that Apple is greatest positioned from a product perspective to make the most of AI’s advantages. Right here’s why:

- Apple singularly has the potential to introduce localized AI fashions which are materially extra responsive and customized than every other firm. We shouldn’t have the precise statistic however could make an informed guess that a minimum of 1 / 4 of the acknowledged capability of an iPhone 16 goes unutilized throughout the lifetime of a median iPhone consumer. What may Apple do with 30-60-90-120 GB of native reminiscence? Rather a lot. Think about that the complete Oxford English dictionary consumes slightly below 600 MB of capability. And, due to their tight integration of iOS and the iPhone {hardware}, localized AI shall be environment friendly and responsive.

- Apple, by way of Siri, has already been skilled to reply to questions in 22 languages (and rising). The iPhone, per this latest Bloomberg interview with CEO Tim Prepare dinner, launched the corporate to lots of of tens of millions of latest customers throughout the globe. Siri, now barely greater than a decade previous, has been bettering its syntax and dialect. It might not be pretty much as good as another assistants, however it’s the most ubiquitous. With elevated AI utilization, Siri’s voice recognition will enhance quicker than others. We began to see among the enhancements to Siri within the newest iOS launch (Voice Management deep dive from Means Internet right here). Warts and all, Apple would quite have a skilled assistant than begin from scratch.

- Apple has a loyal and huge developer group. We predict that is probably the most vital factor for the buyer market. Native processing (with assist for extra complicated queries from OpenAI and different LLMs), together with a international addressable market improves the financial alternative for builders. Because of this, Apple Intelligence turns into a number one LLM practically in a single day.

Apple’s problem just isn’t from AI itself, however from the embedded base of connecting units that shouldn’t have comparable processing capabilities. TVs are getting cheaper however not smarter – the intelligence is coming from peripheral units like Xumo, Apple TV, Fireplace, Roku, and others (and every of those platforms has very completely different improvement roadmaps). What if the peripheral have been embedded in a brand new, smarter show? We will’t assist however suppose that Cupertino has been pondering rather a lot about show consistency, and a whole rethinking of how we view content material is just too huge of a chance for Apple to disregard.

Current experiences would additionally counsel that Apple is significantly contemplating a competitor to Amazon’s Ring and Google’s Nest franchises. Simply earlier than the Christmas Vacation, Mark Gurman of Bloomberg reported that Apple is contemplating a six-inch show that may combine facial recognition (presumably by way of one’s Apple ID) into sensible locks. This sounds small however would firmly tie iOS to the house. One may simply see an integration of Apple CarPlay to storage door opening or paying for occasion parking. Whereas it might not be a big line of enterprise, a sensible door additional cements the worth of Apple to its embedded base.

Backside line: CES continues to evolve as expertise advances. Apple lacks some vital parts of the in-home electronics expertise (e.g., PlayStation or Xbox equal; dwelling home equipment like LG and Samsung), however the firm influences the buyer electronics trade greater than every other. Not like different {hardware} firms which concentrate on producing right this moment’s expertise cheaper, Apple creates differentiation by way of software program integration. This fusion creates a excessive barrier to entry and supplies a really sturdy argument for continued market capitalization acceleration. Slightly than making a extremely disruptive and disintermediating surroundings, AI really makes Apple’s management stronger.

That’s it for this week. We’ll dig into earnings drivers in our subsequent full Temporary (January 12). Till then, in case you have pals who wish to be on the e-mail distribution, please have them ship an e-mail to su*********@***il.com and we are going to embody them on the listing (or they will join immediately by way of the web site).

Lastly – go Davidson School Basketball and Kansas Metropolis Chiefs!

Vital disclosure: The opinions expressed in The Sunday Temporary are these of Jim Patterson and Patterson Advisory Group, LLC, and don’t mirror these of CellSite Options, LLC, or Fort Level Capital.

👇Observe extra 👇

👉 bdphone.com

👉 ultractivation.com

👉 trainingreferral.com

👉 shaplafood.com

👉 bangladeshi.assist

👉 www.forexdhaka.com

👉 uncommunication.com

👉 ultra-sim.com

👉 forexdhaka.com

👉 ultrafxfund.com

👉 bdphoneonline.com

👉 dailyadvice.us