To date, neither Democrats nor Republicans have made shoring up Social Safety central on this yr’s elections. However some American coverage consultants are trying overseas for classes.

Many nations face the identical pressures as america: Their growing old populations have fewer employees to assist retirees. However fairly a couple of nations spend extra on their public-pension packages than america does, providing extra beneficiant advantages and decrease retirement ages.

Making worldwide comparisons is difficult due to financial, political and demographic variations. However Wellesley School economist Courtney Coile, who has lengthy studied public-pension methods all over the world, notes that many nations have enacted coverage modifications lately, whereas Social Safety is basically unchanged because the final main overhaul in 1983.

Partially, Coile stated, that’s as a result of the 1983 reform helped lock in long-run financial savings, so america has spent much less over time. “One large level of distinction is the profit stage is much less beneficiant … than in a bunch of nations,” she stated.

Listed here are 5 charts that present how Social Safety compares with retirement methods all over the world.

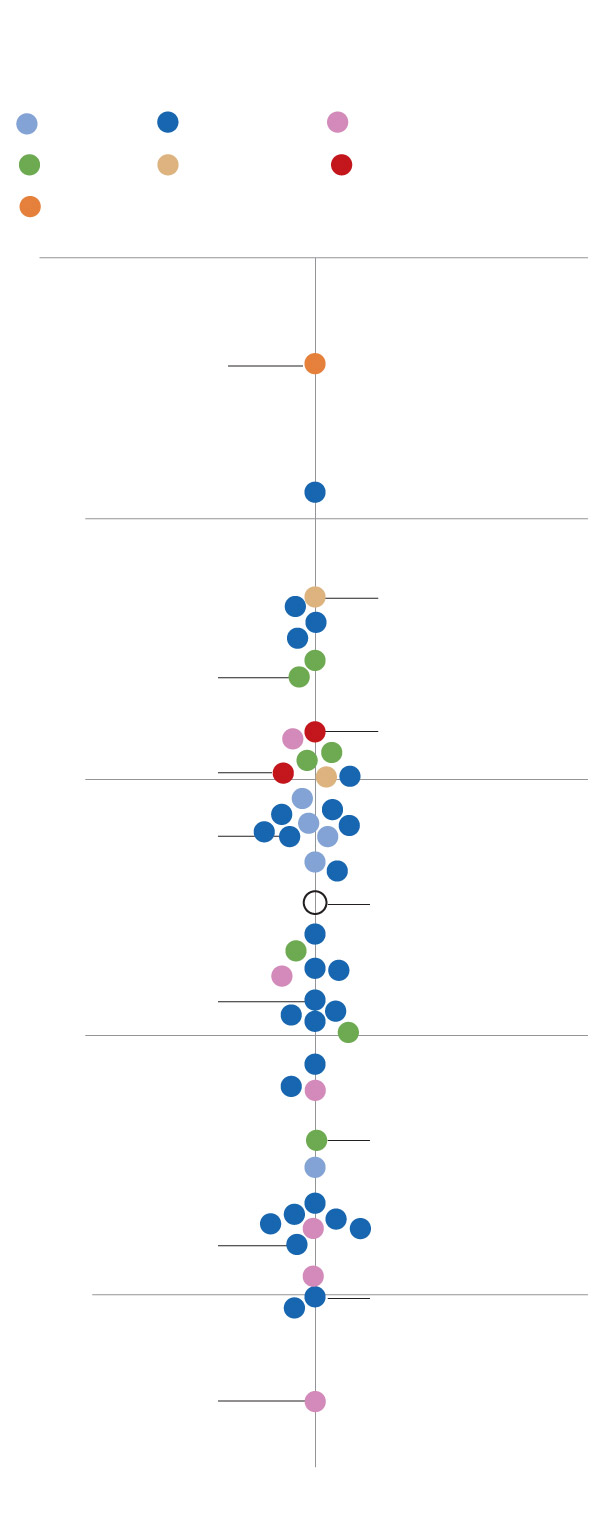

1. Individuals sometimes retire later

Within the broadest phrases, the financing for Social Safety works the identical means because it does in pension methods all over the world: Employees, employers or each pay a portion of the wage as a tax right into a authorities fund throughout the years of employment. Then, when these employees retire, they’re entitled to advantages through a daily test. So one technique to acquire extra and spend much less on public pensions is to lift the age at which individuals begin receiving these advantages.

The U.S. statutory retirement age is 66 or 67, relying in your beginning yr, increased than all however 9 nations — and there’s no political urge for food in both social gathering to lift it. Worldwide, the median is 61. In some nations, employees can select to retire at a barely youthful age — in america, as younger as 62 — and take decrease advantages. Or you’ll be able to wait a couple of years in change for extra beneficiant checks.

A number of nations have adjusted their retirement ages upward lately or have plans to take action. Even so, their employees typically retire youthful than Individuals. Such reforms are sometimes a political minefield: In France, for instance, individuals furiously protested within the streets over President Emmanuel Macron’s proposal to lift the retirement age from 62 to 64.

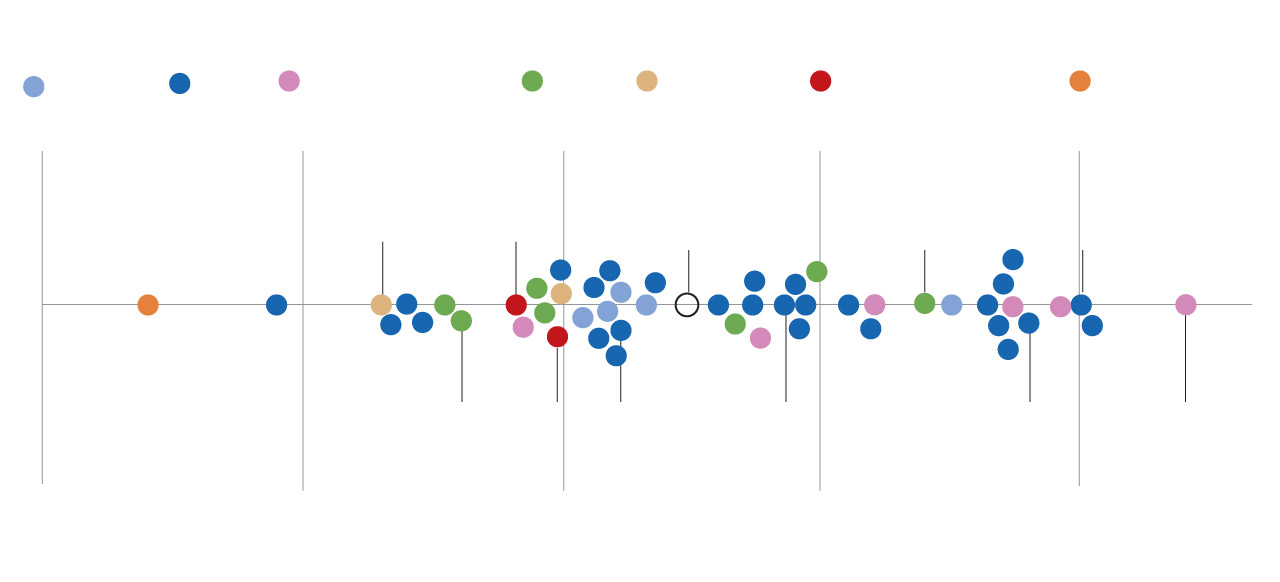

2. Social Safety advantages are modest in contrast with elsewhere

When employees retire and begin amassing advantages, the change of their lifestyle can range tremendously. Social Safety solely replaces about 40 % of the common American’s paycheck, so individuals who rely totally on Social Safety usually see a steep drop-off in month-to-month earnings.

% of pre-retirement earnings changed by pension

% of pre-retirement earnings changed by pension

In lots of different nations, advantages are extra beneficiant and are available nearer to completely changing employees’ paychecks. Individuals, in contrast, rely extra on personal pensions and tax-advantaged financial savings accounts comparable to 401(ok)s, with contributions made throughout their working lives matched by employers. However not all employees have a lot or any financial savings — and fewer and fewer have union or firm pensions — some extent that argues in opposition to across-the-board profit cuts to realize Social Safety’s solvency.

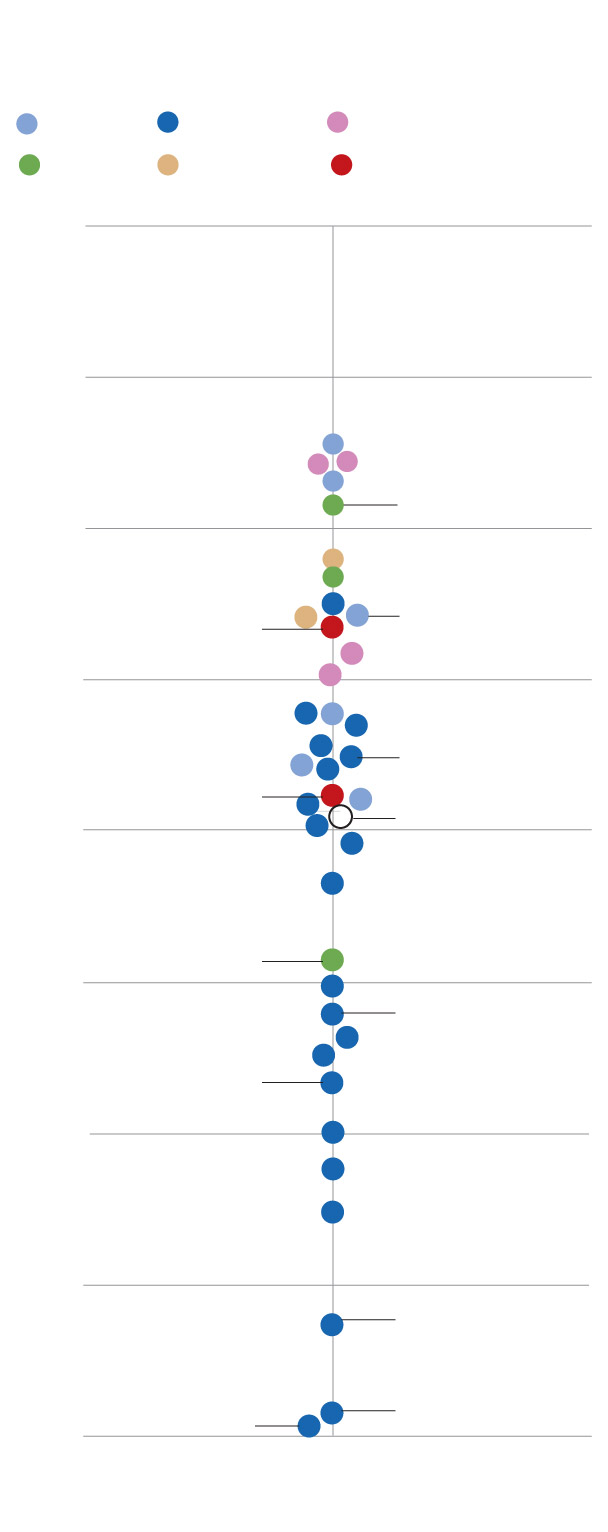

3. As a share of GDP, Social Safety spending is about common

Social Safety is likely one of the priciest gadgets within the U.S. federal finances, as are pension methods in lots of different nations. At 7.5 % of gross home product, america spends about the identical on Social Safety because the OECD common, although a lot lower than some industrialized nations comparable to France, Greece and Italy.

% of GDP spent on public pensions by nation

% of GDP spent on public pensions by nation

Social Safety can be considerably strengthened if beginning charges went up, resulting in a better ratio of employees to retirees. However fertility tendencies in america, as all over the world, have been dropping for years. Nancy Altman, president of the advocacy group Social Safety Works, argues that growing immigration, moderately than making an attempt to carry beginning charges, would finest handle this labor-force scarcity. “We’re not being good guys by permitting immigration,” she stated. “It’s self-interested. It’s higher for our economic system.”

4. Social Safety tax charges are decrease than in lots of different nations

Social Safety is funded by taxes paid by employees and their employers over the course of their careers. American employees pay 6.2 % of their wages whereas their employers pay an extra 6.2 %, including as much as a complete of 12.4 %. In 113 nations, the entire contribution price is increased than America’s 12.4 %; the worldwide common is 16.3 %.

There’s nice variance each in who pays and the way a lot they pay: Romanian employees, for instance, contribute 25 % of their wages, whereas their employers normally pay nothing. On the opposite finish, salaried employees in Australia, Lebanon, Russia and Ukraine contribute nothing, whereas their employers foot the invoice.

In america, some Democrats have cautiously endorsed the thought of elevating tax charges, whereas conservatives argue that such comparisons are deceptive. Social Safety relies on progressive allocation — low-wage employees get extra again in advantages relative to their wage, whereas high-wage employees get much less again. Greater tax charges are unusual in nations with comparable redistribution, stated Andrew Biggs, an American Enterprise Institute researcher who labored on Social Safety reform within the George W. Bush administration.

“When the tax charges are inclined to get excessive, the advantages are inclined to get much less progressive,” Biggs stated. “You are able to do this excessive tax price in case you make it much less progressive, as a result of individuals really feel like they’re simply paying for themselves, not different individuals.”

Whereas its final calculation is now over a decade outdated, the OECD has rated how nations in contrast in redistributing advantages. On a scale starting from 0 (under no circumstances redistributive) to 100 (probably the most progressive), the OECD ranked the U.S. system at 42, barely above the OECD common of 39. That’s extra progressive than nations like Finland (4) or Sweden (destructive 13, which means the system is regressive and takes from the poor to provide to the wealthy). In these Scandinavian nations, tax charges are increased, however the relationship between lifetime earnings and retirement advantages is far nearer, Biggs identified.

Alternatively, some nations that redistribute advantages extra are inclined to have decrease tax charges: Canada will get a 92 for progressivity — one of many highest on the earth — and has a tax price of 10 %.

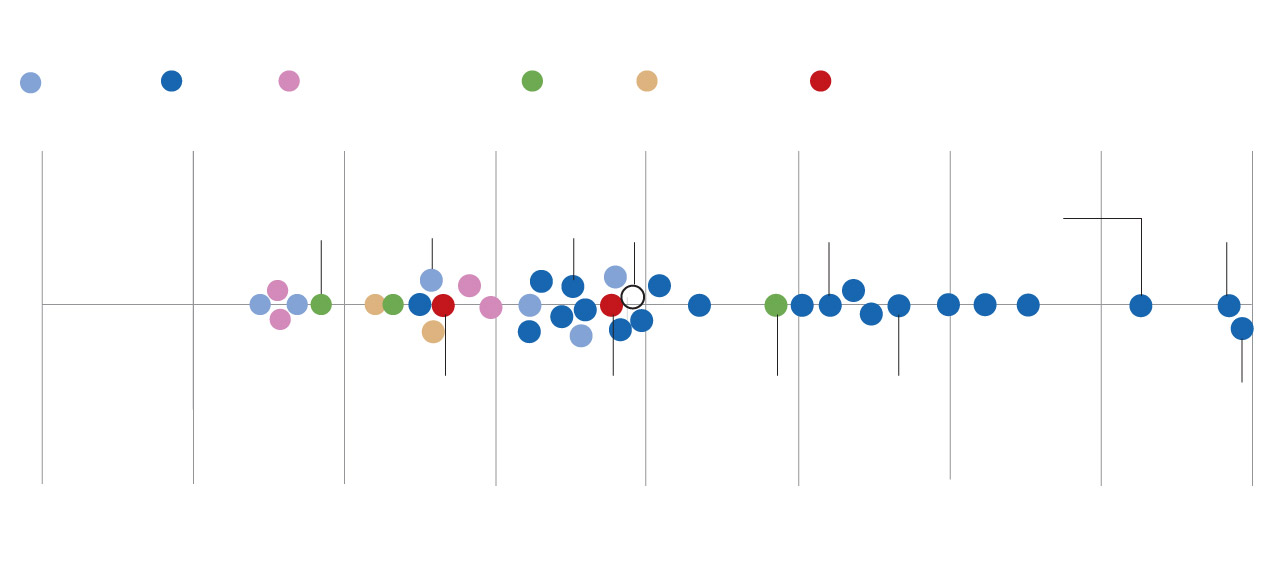

5. Social Safety taxes are capped for the richest Individuals

Current debates over Social Safety financing usually give attention to the brink at which American employees not pay that 6.2 % tax on their wages, which is at present $168,600 in annual earnings. Earnings above that cap usually are not topic to Social Safety taxes, which suggests big chunks of earnings are exempt for extremely compensated employees. (Advantages are additionally capped, so Social Safety additionally replaces a smaller share of earnings for top earners.)

Many Democrats have argued that elevating or eliminating the cap would usher in sufficient cash to assist shore up Social Safety for many years to come back; President Biden additionally included modifications to the cap in his finances proposals. The concept has parallels elsewhere: Costa Rica, Denmark, Estonia, Finland, Iceland and Portugal are among the many nations that don’t cap wages topic to retirement taxes.

In nations that do have caps, some exempt extra earnings than others. In Canada, the cap exempts earnings beginning at simply 79 % of the common employee’s wage, which means even unusual employees don’t pay taxes on a portion of their earnings. In nations like Mexico and Colombia, in contrast, the cap doesn’t kick in till an individual has earned many occasions the nationwide common — which means extra extremely compensated individuals pay taxes on extra of their earnings.

The American cap of $168,600 works out to about 2.3 occasions the common employee’s annual wages, placing america near the median globally.

👇Comply with extra 👇

👉 bdphone.com

👉 ultraactivation.com

👉 trainingreferral.com

👉 shaplafood.com

👉 bangladeshi.assist

👉 www.forexdhaka.com

👉 uncommunication.com

👉 ultra-sim.com

👉 forexdhaka.com

👉 ultrafxfund.com

👉 ultractivation.com

👉 bdphoneonline.com