July greetings from Cedar Rapids, Kansas Metropolis and Washington, DC. Kudos to my brother-in-law, Andrew Ashcroft, for incomes his promotion to Captain within the U.S. Navy. It was an honor to affix household and associates on the Pentagon earlier this month to have fun his achievement.

It’s mid-July and the second quarter earnings season is upon us. Right here is the present schedule of earnings bulletins for the Fab 5 and the Telco Prime 5:

| Firm | Day | Date | am/pm |

| Verizon | Monday | July 22 | am |

| Comcast | Tuesday | July 23 | am |

| Alphabet | Tuesday | July 23 | pm |

| AT&T | Wednesday | July 24 | am |

| Constitution | Friday | July 26 | am |

| Meta | Wednesday | July 31 | pm |

| T-Cellular US | Wednesday | July 31 | am |

| Apple | Thursday | August 1 | pm |

| Microsoft | TBD | TBD | TBD |

| Amazon | TBD | TBD | TBD |

We are going to proceed to replace this chart by means of the spreadsheet distributed in our online-only interim Briefs. Our subsequent full Transient might be on July 28th, which ought to break up the ends in half.

After a full market commentary, we’ll use the rest of the Transient to spotlight a number of objects (together with the expiration of the Reasonably priced Connectivity Plan or ACP) that can affect earnings outlooks.

Two scheduling notes – Jim might be on the Fiber Join 2024 convention in Nashville on July 29 and 30. If you want to hook up with talk about the trade typically and/or his new position as CEO of CellSite Options, please attain out to him by means of LinkedIn or by means of e-mail. Secondly, if you may be within the Boston space the night of July 31, Jim might be internet hosting a cheerful hour in Boston that night. Please attain out to Jim in case you are excited by attending. The situation might be decided based mostly on the variety of attendees (at present 10).

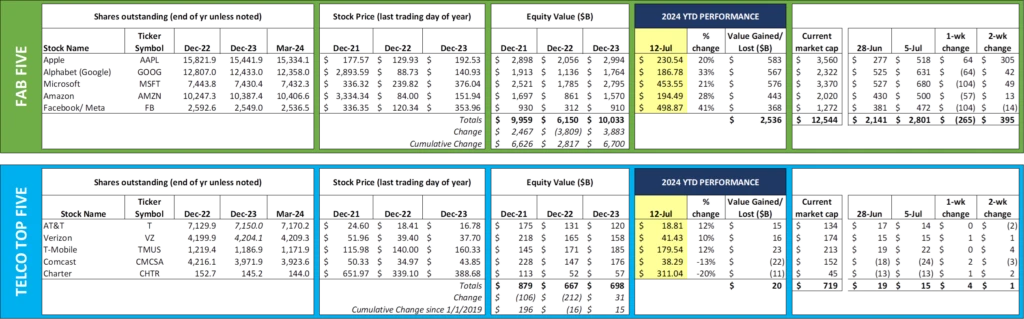

The fortnight that was

Whereas the Fab 5 had a down week in mixture (-$265 billion), it managed to develop $395 billion over the fortnight. To date in 2024, the group has gathered a further $2.54 trillion in market capitalization. The Telco Prime 5 additionally managed to realize over the past two weeks (+$1 billion) and have elevated $20 billion thus far in 2024. It’s onerous to consider that on the finish of 2021 Comcast was the most important telecommunications firm within the US whereas T-Cellular was fourth. Magenta’s potential to combine Dash with minimal losses, in addition to wonderful execution of a capacity-utilization pushed mounted wi-fi technique, drove them to the highest spot with practically $40 billion in market capitalization to spare.

Samsung’s Unpacked occasion (from the Louvre in Paris) was the large information story of the previous week. New watch, new foldable smartphones (the Z Fold and Flip 6 – specs right here and pictured close by), and even a sensible ring had been debuted to enhance well being information colletion. Having used the Samsung Watch 6 Traditional (now yesterday’s model) for a number of weeks, it’s onerous to consider the necessity for a hoop with common watch put on – the incremental well being measurements are minimal. However which may be the purpose – there are specific situations when the simplicity of a hoop can bridge any know-how fears and a watch won’t be the most effective resolution.

The place Samsung (and Apple) has the chance to excel is after they incorporate related and customized intelligence – from a doctor, from a clinic, from a group, from household historical past, and even a big language mannequin – into the day by day affected person information feed. Answering the query “What do I do now?” by means of this new ditigal array is certainly in an eary stage, however the implications are important. Whereas we acknowledge that Apple and Samsung wish to dominate this area, it could be higher fitted to a well being care data firm like Oracle Well being or Epic Programs to ingest the data given their present relationships with hospitals and physicians.

The significance of community safety was additionally reemphasized this week when AT&T relvealed that Name Element Data (CDRs) from Could to October 2022 had been downloaded by means of cloud service Snowflake for over 100 million prospects (information launch right here). Since AT&T has not denied that authorities units had been part of the breach (based on this New York Instances article, AT&T serves the State Division, Division of Protection, Division of Nationwide Safety, and different data-sensitive branches), consideration ought to flip to the communications exchanges themselves. That data could possibly be significantly dangerous to nationwide safety although the contents of every textual content message (or telephone name) weren’t disclosed.

Thankfully, the CDRs include no message content material. Sooner or later, nonetheless, Synthetic Intelligence (AI) will generate dialog summaries and transcripts. How will that information be safeguarded? Will or not it’s in a way much like delicate profile billing/ monetary information? What position will encryption play? Many questions stay unanswered, and the dangers of early adoption with out addressing every safety concern create publicity.

Lastly, it’s price noting that Frontier and Stonepeak are speaking about $500 million to $1 billion in extra funding for brand new fiber builds per this July 3 Bloomberg article. We presume this could be set as much as bolster the Frontier’s success throughout BEAD funding negotiations (which means that a number of the remaining capital wanted would possibly come within the type of BEAD grants). How they might construction their settlement to fulfill Stonepeak’s traders stays to be seen, however Frontier has been capable of concern income time period notes with relative ease (see right here for his or her June announcement).

The bottom quartile (2Q earnings preview)

There’s little doubt that some of the necessary questions popping out of the quarter is “How did [your company name] deal with the demise of the Reasonably priced Connectivity Plan (ACP)?” Many of the responses might be nuanced, reminiscent of “none of our postpaid retail prospects had been impacted” or “even when there was a income affect, our EBITDAs had been low so there shouldn’t be quite a lot of money stream affect.”

The higher query to ask, nonetheless, is “How did [your company name] achieve from the turmoil created by the tip of ACP?” The solutions to that query might be answered in a different way by wi-fi vs. fiber/ wired firms. Spectrum is fungible, deployed fiber isn’t.

The issue with this reply, nonetheless, is that T-Cellular is simply deploying mounted wi-fi the place they’ve extra capability. That situation could not overlap with post-ACP demand from potential T-Cellular mounted wi-fi prospects. That leaves Verizon as he major know-how different versus cable/ fiber/ telco (we assume AT&T is simply deploying their Web Air product for residential prospects on a really restricted foundation).

If an reasonably priced charge was decided (we expect that $40-50/ month with no authorities subsidy is as excessive as cable can go to serve the bottom quartile of broadband prospects – this quantity could also be a lot decrease in Multi-Dwelling Models or MDUs), then we expect that Constitution, Comcast, Cox and others most likely noticed many fewer web losses than analysts count on. Nonetheless, with the $30/ month ACP subsidy gone, prices of monitoring cost/ suspending/ reconnecting possible grew within the quarter. The result’s a big portion of consumers paying $40-50/ residence for broadband however hanging on by a thread. And the chance that future builds in decrease demographic areas will proliferate with BEAD funding is diminished – if any carriers present up, the development will possible be absolutely funded by BEAD if value controls are mandated.

The choice to BEAD is to have elevated utilization by means of wi-fi units (Hotspots, extra cellular-only utilization, particularly for smaller households). Most plans have limitless utilization (no caps) however obtain deprioritized information after 50-100 GB is consumed. Hotspot utilization continued to be restricted as nicely (15-60GB is the possible vary, which might assist a “[very] mild streaming” consumption mannequin at 480p however unlikely to have the ability to fulfill streaming/ distant studying/ different purposes).

That is the place merchandise like Comcast’s NOW Cellular are available in. At $25/ line (taxes and costs are included in that charge per the hyperlink), with 20 GB of information per line, Comcast can serve primary wi-fi and information wants for barely greater than the after-tax value of working two hours at minimal wage. Not free, however low value. We predict that Comcast hit a house run with their NOW product line, however sustaining that base isn’t going to be low-cost. The corporate has a protracted historical past of coping with decrease quartile cable payments, nonetheless, and so they appear to be in an excellent place to handle issues.

Fierce catalogued every service’s broadband plans in this April 16th article. The array of choices is broad, and, as famous earlier, tends to favor conventional wired options. Whereas many of the subscriber impacts might be on the pay as you go or MVNO ranges in wi-fi, the wired suppliers might be breaking out ACP losses for the primary time and the EBITDA affect could be stunning, particularly within the case of Constitution. Our view, nonetheless, is that conventional wired suppliers are extra centered on sustaining their higher-quality buyer bases as Frontier, AT&T, and different FTTH suppliers like Metronet proceed to broaden and develop.

The place does this go away the decrease quartile of broadband customers? Ready for BEAD implementation, and that would take a while. In the meantime, carriers like Tracfone, Metro and Cricket will proceed to slowly enhance their premium information allocations, and cable MVNOs will proceed to bundle cellular with discounted DOCSIS providers.

Outdoors of the bottom quartile, listed here are another particular questions that we’d advocate get requested on the calls:

- For Verizon: Is the under OpenSignal chart true (hyperlink right here)? Why is Verizon considerably lagging in 5G availability and what can the corporate do to enhance general protection? What extra expenditures will Verizon must make (capex, towers/ working leases) to succeed in 70%? What’s an affordable determine to attain by the tip of 2025?

- For AT&T: We predict that AT&T is shocked by the success of AT&T Web Air (primarily for companies at the moment). What are your plans to broaden AT&T Web Air to extra locations, together with Work from House (WFH) and/or redundant entry?

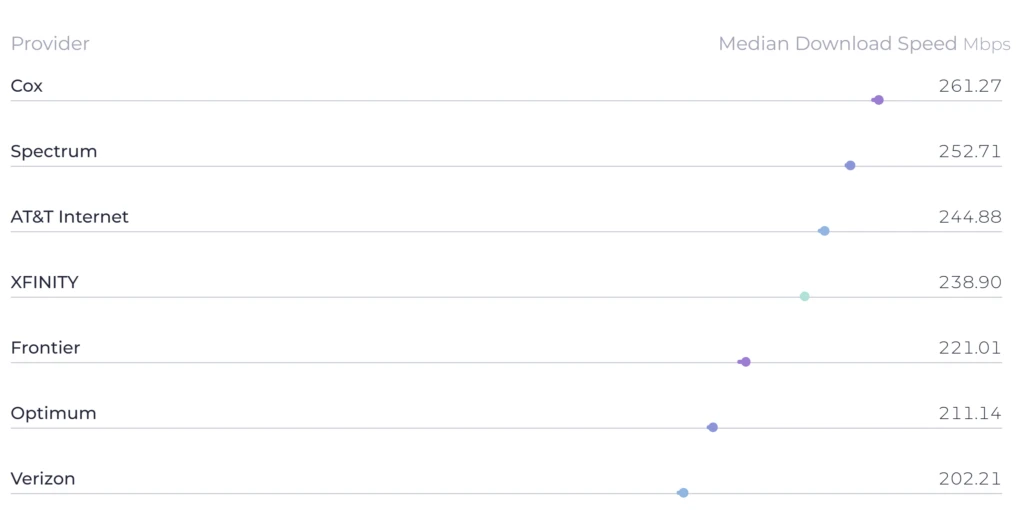

- For AT&T: This chart exhibits the latest mounted broadband speeds from Ookla as of This fall 2023. Why is AT&T’s median obtain pace constantly decrease than the marketed pace of the bottom tier plan (300 Mbps)? Given the upgrades mirrored in reported ARPU, shouldn’t AT&T be the quickest? Notice: AT&T recorded the quickest add pace of all US mounted broadband suppliers.

- For AT&T: Right here is the assist article outlining slightly dramatic modifications in legacy pricing plans. How has this variation impacted calls to care, churn, and ARPU/ downgrades? What are the EBITDA implications of this variation?

- For AT&T: The US Census Bureau lately launched their quickest rising markets (see our Sunday Transient protection right here). With so many of those markets served by AT&T, shouldn’t fiber subscribers be rising sooner then at present proven? Isn’t AT&T a web beneficiary of the family migration from North to South (and West)?

- For T-Cellular: How will T-Cellular overcome authorities objections to their acquisition of US Mobile’s operations? Will T-Cellular need to make important concessions? Is the corporate prepared to tackle a expensive and protracted lawsuit with the [Biden 2nd term] DOJ?

- For T-Cellular: How is the 800 MHz public sale progressing, and the way will the businesses use the proceeds from the public sale? Has the corporate made any extra progress on community modifications that will improve the capability accessible for mounted wi-fi entry?

- For cable: The second half of the 12 months goes to be stuffed with political promoting. With Wisconsin (largely Constitution), Pennsylvania (Comcast and others), Michigan (Comcast/ Constitution), Arizona (Cox), Nevada (Cox), and North Carolina (Constitution) possible key battleground states, and folk like Elon Musk, Ken Griffin, and Paul Singer possible contributing file quantities, how good may it get for promoting within the second half of 2024?

That’s it for this week. Many thanks for the feedback and notes in regards to the final Transient which centered on capital spending. Based mostly in your requests, we’ll do our greatest to replace that data twice per 12 months. Earnings might be dominating the subsequent two Briefs, and we’ll possible submit interim updates on-line. Till then, when you’ve got associates who want to be on the e-mail distribution, please have them ship an e-mail to [email protected] and we’ll embrace them on the checklist (or they will enroll straight by means of the web site).

Lastly – go Sporting KC, Group USA, and Kansas Metropolis Royals!

Vital disclosure: The opinions expressed in The Sunday Transient are these of Jim Patterson and Patterson Advisory Group, LLC, and don’t mirror these of CellSite Options, LLC, or Fort Level Capital.

👇Comply with extra 👇

👉 bdphone.com

👉 ultraactivation.com

👉 trainingreferral.com

👉 shaplafood.com

👉 bangladeshi.assist

👉 www.forexdhaka.com

👉 uncommunication.com

👉 ultra-sim.com

👉 forexdhaka.com

👉 ultrafxfund.com

👉 ultractivation.com

👉 bdphoneonline.com